You can now validate any credit card number using our credit card validator online! Our credit card validator and checker checks the credit card number and return valid results such as Major Industry Indentifier which can be checked by analysing the credit card number prefix. Our validator checks MasterCard, Visa, Discover Card, JCB Card, and American Express cards.

Also check out our new tool IBAN Checker - automatically checks IBAN entered if valid or not.

We'll check your number against the Luhn Algorithm to see if it is a valid credit card number.

The first digit of a credit card number represent the category of entity which issued the card.

The first six digits of a card number identify the institution that issued the card to the card holder.

Digits 7 to final number minus 1 (the last is the checksum) indicate the individual account identifier.

We check for the following:

The Luhn algorithm or Luhn formula, also known as the "modulus 10" or "mod 10" algorithm, is a simple checksum formula used to validate a variety of identification numbers, such as credit card numbers, IMEI numbers, National Provider Identifier numbers in the United States, Canadian Social Insurance Numbers, Israel ID Numbers and Greek Social Security Numbers (ΑΜΚΑ). It was created by IBM scientist Hans Peter Luhn and described in U.S. Patent No. 2,950,048, filed on January 6, 1954, and granted on August 23, 1960. [source:wikipedia]

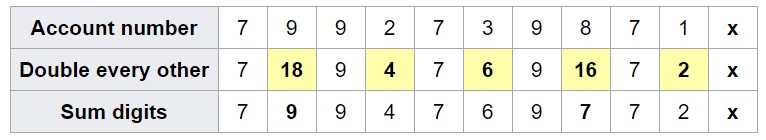

Assume an example of an account number "7992739871" that will have a check digit added, making it of the form 7992739871x:

The sum of all the digits in the third row is 67+x.

The check digit (x) is obtained by computing the sum of the non-check digits then computing 9 times that value modulo 10 (in equation form, ((67 × 9) mod 10)). In algorithm form:

(Alternative method) The check digit (x) is obtained by computing the sum of the other digits (third row) then subtracting the units digit from 10 (67 => Units digit 7; 10 − 7 = check digit 3). In algorithm form:

This makes the full account number read 79927398713.

Absolutely not! Credit card number entered on our validator undergone process using validating rules. However, we do not store these credit cars for security purposes.

Yes! Our validator only checks the Major Industry Identifier or MII, the Personal Account Number and Issuer Identification Number. You can read the detailed table for MII Below.

| MII Digit | Category |

|---|---|

| 0 | ISO/TC 68 and other industry assignments |

| 1 | Airlines |

| 2 | Airlines, financial and other future industry assignments |

| 3 | Travel and entertainment |

| 4 | Banking and financial |

| 5 | Banking and financial |

| 6 | Merchandising and banking/financial |

| 7 | Petroleum and other future industry assignments |

| 8 | Healthcare, telecommunications and other future industry assignments |

| 9 | For assignment by national standards bodies |

Using the table you assumed that Visa which starts with number 4 belongs to Banking and financial as well as MasterCard which is prefixed with number 5.

INFO: Credit card number generated are valid but DOES NOT WORK like an actual credit card. They do not have any actual REAL VALUE. They are for data testing and verification purposes only.