Everything has 2 sides, so does the credit card also. We know that there are numerous advantages to using a credit card. Whenever you go for applying for a credit card, people will tell you about the different advantages of a credit card. But then, you should also know that there are some huge disadvantages of using a credit card. But no one will make you aware of the disadvantages of using a credit card. Have you heard the marketing executive who calls you to buy a credit card telling you any disadvantage of it? No, they do not tell us the disadvantages, because it will impact their marketing negatively.

Most of us give lame excuses to use a credit card like for buying something huge on EMI, or for building the credit score, for making use of it during emergencies, and many such other reasons. And we easily get trapped in all these reasons, and we get a credit card for ourselves. But we suggest that if you are planning to get a credit card, do not just check the advantages or benefits of a credit card.

Also, check the disadvantages of it, so that you can decide whether you need it or not. Here, we are going to tell you about the different disadvantages of using a Credit Card which you might not be aware of. Or if you are aware of, you might be simply neglecting it. Let’s check what these disadvantages are.

When you apply for a credit card, the marketing executive would have told you about this charge. But they explain you in such a way, that you do not feel bothered about it. They will tell you that it is just a small amount which you will have to pay only once in a year and you will get more reward points then this amount. By listening about the reward points, we just skip the annual charge thinking that it is good to get reward points.

We also know that there are many financial institutions which offer you a credit card for a lifetime without any annual charges. But not all of them are the same. Most of the financial institutions charge you an annual fee for using the credit card. Even if you have not used it the whole year, you will still have to pay the credit card annual fees for keeping it.

The annual fees can be very little also or it can be very high also depending on the card which you are using and its value. So, if you are using a credit card with annual fees payment, just check how much they deduct or how much you pay every year just for keeping that card. We do not think of this when we apply for the credit card, but we regret later on about it.

Chart from shiftprocessing.com

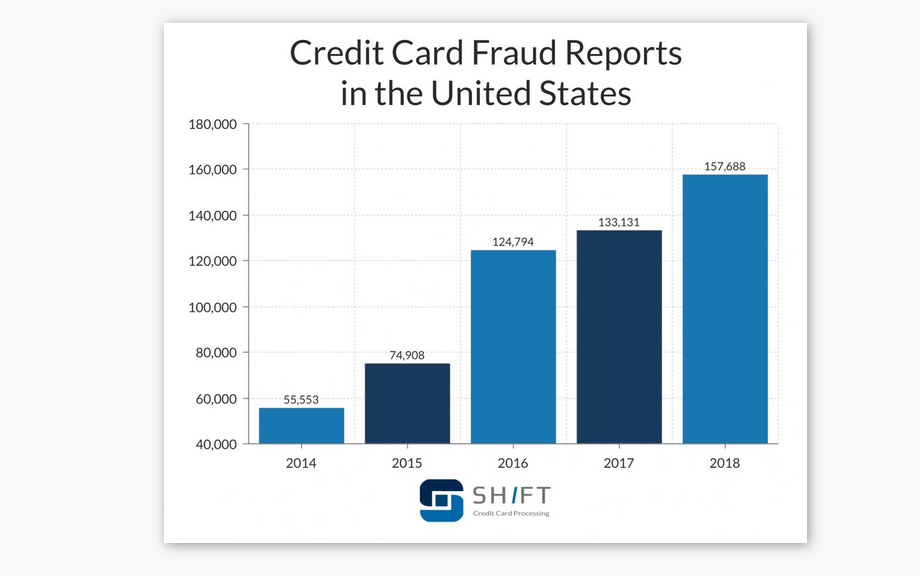

Chart from shiftprocessing.comIn 2018 alone $24.6 Billion is reportedly lost due to credit card fraud. You all would have heard about a lot of credit card fraud. There are many fraud schemes which people will provide you regarding your credit card and will trap you in it. In most of the cases, the fraud amount is compensated and is settled. But if it is not being settled by the financial institutions then you may have to pay the complete amount which can be very huge also. Even if the financial institution has compensated the amount, it is not that much easy to deal with the fraud. It is a time-consuming process and it also gives one unnecessary stress.

This happens mostly in case of credit card only, and it hardly happens in case of debit card. Because, credit cards have huge credit limits, and people easily fall in the trap thinking that there is some offer on their credit card. So, if you are already making use of credit card, beware of such frauds. If you are planning to make use of a credit card or applying for a credit card, think before you apply.

We know that there is a certain payment date for the credit card bill payment, and till that date, it is the interest-free period. But if you are carrying the amount from one month to another, you will end up paying high-interest charges. You may have to pay a lot more if you keep taking the balance amount to next month. Most of us are not aware of this fact, that we will have to pay a lot of interest rate if we are failed to pay the credit card bill. Some people will suggest you that pay the minimum amount of the bill. But you should know, that even after paying the minimum amount, you will have to pay the interest.

Even if you are withdrawing cash from your credit card during the emergency, in that case also, there are high-interest charges. That is why it is always suggested that one should not withdraw money from the credit card. Also, if you are taking a credit card bill from one month to another, and you are shopping using your credit card during this time, avoid doing it. As you will be charged high interest on shopping also if you have not cleared your previous bill of the last months. Payment after the due date will also lead to the late fees charges which are again very high. Even there are high-interest charges on buying things on EMI also.

If you are planning to buy things on EMI using your credit card, be ready to pay high-interest rates.

When we get credit cards, we develop a habit of buying or shopping more than the required. Even if we do not need anything, we still feel that we have money and we end up buying it. This develops our habit of buying too many things which means more credit card bill amount. Now, you can think yourself only, that when more than half of your income or earning will go in paying credit card bill, how you will be able to make any saving. People who are making continuous use of credit cards are not being able to save money.

There are a few other disadvantages also of using a credit card like damage of credit score, the habit of being in debt, and credit card surcharges, etc.

INFO: Credit card number generated are valid but DOES NOT WORK like an actual credit card. They do not have any actual REAL VALUE. They are for data testing and verification purposes only.